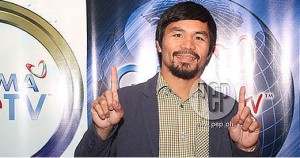

Turn the new challenges faced by Sarangani Representative Manny “Pacman” Pacquiao for supposedly $ 18 million (P774 million) worth of tax he paid the Internal Revenue Service (IRS) in the United States.

This is despite the controversies currently facing Pacquiao in the Philippines because of the claim of the Bureau of Internal Revenue (BIR) in alleged unpaid taxes worth P2.2 billion.

Currently freeze bank deposits as Manny in accordance with the law of the BIR.

In documents obtained by gossip website TMZ , it appears that the tax was not paid to the IRS for Manny earned in his fight from 2006 to 2010.

Here’s the breakdown of annual taxes allegedly to Manny from IRS.

2006: $ 1,160,324.30

2007: $ 2,035,992.50

2008: $ 2,862,437.11

2009: $ 8,022,915.87

2010: $ 4,231,999.01

Also according to bleacherreport.com , three of the match that happened in Texas , no state income tax , but still required to pay federal income tax .

On the IRS website , the federal income tax is the tax paid by U.S. citizens ” regardless of the state or county in Which They Live . ”

If a person living with any of 50 states in the U.S. , he obliged to pay taxes to the federal government .

Meanwhile , the state income tax is also determined by each state government and the amount of the tax is determined by the income of a resident .

Seven of the 50 states in America do not restrict the income tax : Wyoming , Washington , Texas , South Dakota , Nevada , Florida , and Alaska .

The agreement stated that the income tax paid by a Filipino in the U.S. can be credited to its income tax liabilities in the Philippines.

Manny also accused the BIR probers of not paying attention to the reports submitted by Top Rank Promotions ( boxing promotion company holding against Manny ) , as the other transaction documents allegedly proving that he paid his IRS .

In that report questioned Bob Arum , Top Rank chief executive officer , the claim of the BIR with Manny .

Tax laywer and former employees of the Department of Justice Tax Division in New York Arum .

Arum yield , under the law of America ‘s Top Rank required to pay the IRS funds that were withheld from Manny earned from his fights and endorsements in the U.S.

Arum added that the BIR sent electronically furnishing the copy of such withholdings .

BIR but insisted that they must be certified true copy of the tax returns from the IRS .

Arum also insisted they be given all the necessary documents and receipts confirming payment of taxes Manny in America .

Arum was driven more by BIR Commissioner Kim Henares to audit Manny earned in Top Rank .

Arum said: “Let them come to our office, let them sit down, and we will take them through every single wire transfer.

“Because I can represent here today that for all the time we promoted Manny, 30 percent was taken out of any moneys paid to Manny, and that includes not only his fights but also endorsements in the United States.”